While many banks are working on improving their customer service, some banks already got it right. Here's a story about sales force strategy that works.

Last week I woke up to $867.35 missing from my bank account. $138.63 spent at a gas station in Spain. I don’t own a car. And I’m not in Spain. $73.65 on cigarettes in Texas. I don’t smoke either, and I’m definitely not in Texas.

I fished my phone out of my purse and frantically called Simple’s customer service line while racing towards the morning bus. If you haven’t heard about Simple, it is an online bank in the style of Moven, and you can read more about them on Jim Marrous’s blog here. But back to me.

What was going to happen? My mom had warned me not to trust the internet with my money. Honestly, I did not research Simple fully before making the switch, I was feature-dazzled (their saving automation goals really did it for me).

What if they don’t have the standard coverage that is assumed with a traditional branch bank? That $867.35 was going to important things: my student loans, my electricity bill, my credit card payment.

Making the Switch from Traditional to Online Banking

Around 6 months ago I had switched my banking account from TD Bank to Simple, and was happy as a clam. I was getting slammed left and right with fees from TD Bank. Simple was a shining beacon in the banking world when I read their FAQ. Upfront and honest, using real people language. This is what I was searching for in a bank.

Transferring my existing accounts over to Simple was easy. Only one slight hitch - my debit card got lost in the mail. Simple’s customer service team swiftly resolved the issue and even sent me this funny gif upon resolution. Needless to say, I was over the moon, and instantly urging friends and family to switch.

My Simple Bank Customer Service Experience

After seeing the missing funds in my bank account, I called the customer service line in a panic. Used to the 24/7 coverage of TD Bank, I was dismayed to find out that I had reached a machine. Was I wrong for referring everyone to this bank? This machine, however, was no ordinary automated voice. I expected a voice telling me how great my bank was and trying to up sell me on products. Instead, it was helpful and reassuring, telling me the thing I needed to know right away – I could block my card with the phone app in order to prevent further mysterious charges. Also, the recording suggested that I leave a voicemail, so someone could get back to me right away.

I did just that and while safely on the bus being whisked to work, I blocked my card. It was a satisfying and reassuring little deed – take that mysterious card number thief!

A few minutes later, I was contacted by Simple’s customer service rep, who was all over it. She double-checked that all of the transactions had been by signature so that I would receive the full amount back. So I knew that’d I’d get all my money refunded… but what now?

Going Above and Beyond for Banking Customers

If I was a member of a traditional bank and had my debit card stolen, I could go into a branch and pull money out through the teller. But Simple is an online bank. But of course they had thought of that. This amazing representative thought ahead for me and offered a way for me to access my cash easily. An hour after the initial call, another associate called me as she was worried about me and wanted to make sure I didn’t need anything. Simple Bank treats me like a friend, and that made all the difference during this stressful occasion.

Simple Makes Banking Customer Experience Look Easy

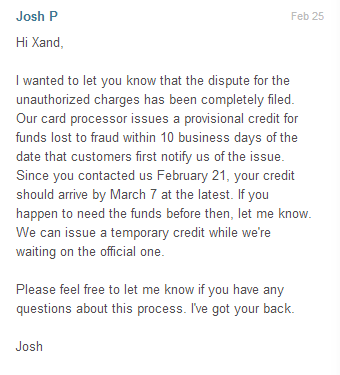

One last problem – what if I didn’t have enough money in my account to make sure all my transactions posted properly? It would be a full ten days before I could receive my money back. Ten days is a long time. But never fear because Simple had me covered. I didn’t even have time to worry about that problem before they sent me this friendly email:

How Can You Keep Your Bank Customers Happy?

We customers are really pretty simple. We only have three requirements from our bank (as previously written about it “What Customers Wish Banks Would Improve”):

We customers are really pretty simple. We only have three requirements from our bank (as previously written about it “What Customers Wish Banks Would Improve”):

- Products and fees

- Put customers first

- Find and keep talented employees

Simple really understands this. They have taken all of these ideas and run with them. They completely exceeded my expectations and desires. So take it from this loyal advocate – these are my priorities and I’ve been spreading the word about my bank. Do your customers do the same?

Would you like to know more about how we got to these three priorities? Click here to download our research study about banking customers.

-Xand Griffin

If you work for a bank, and you want to learn more about customer experience, then click on the button below to enroll in our email course. You'll learn the key basics of customer experience improvement and get access to helpful resources and materials.

%20(1).png)