We work with a number of banks and credit unions, all of which are committed to using customer feedback to deliver a great customer experience. We recently aggregated data from across all of our clients to see what we could learn about overarching trends in banking customer experience.

Here are five highlights from the study, which you can download in full here.

#1: Customers are reporting positive experiences.

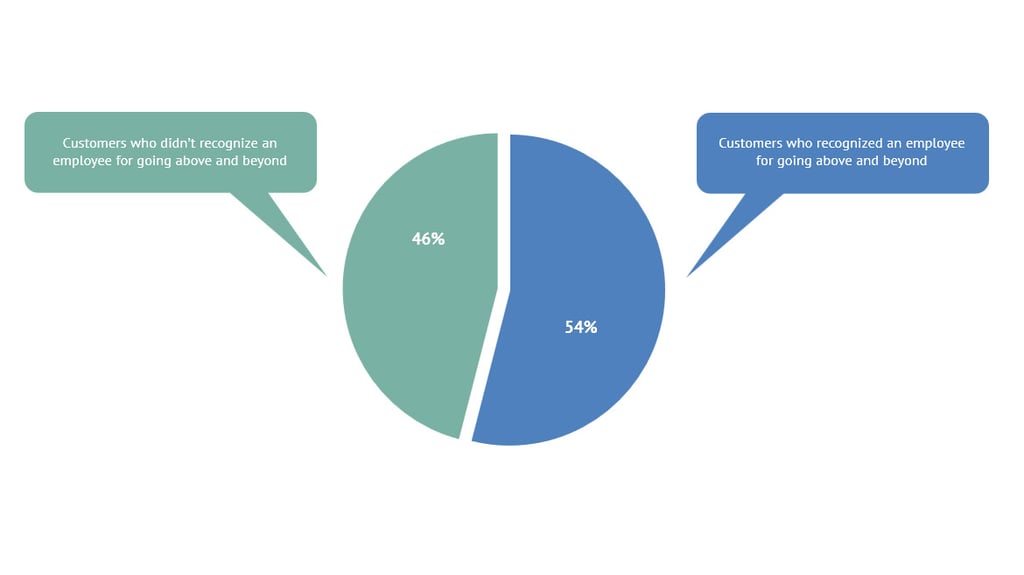

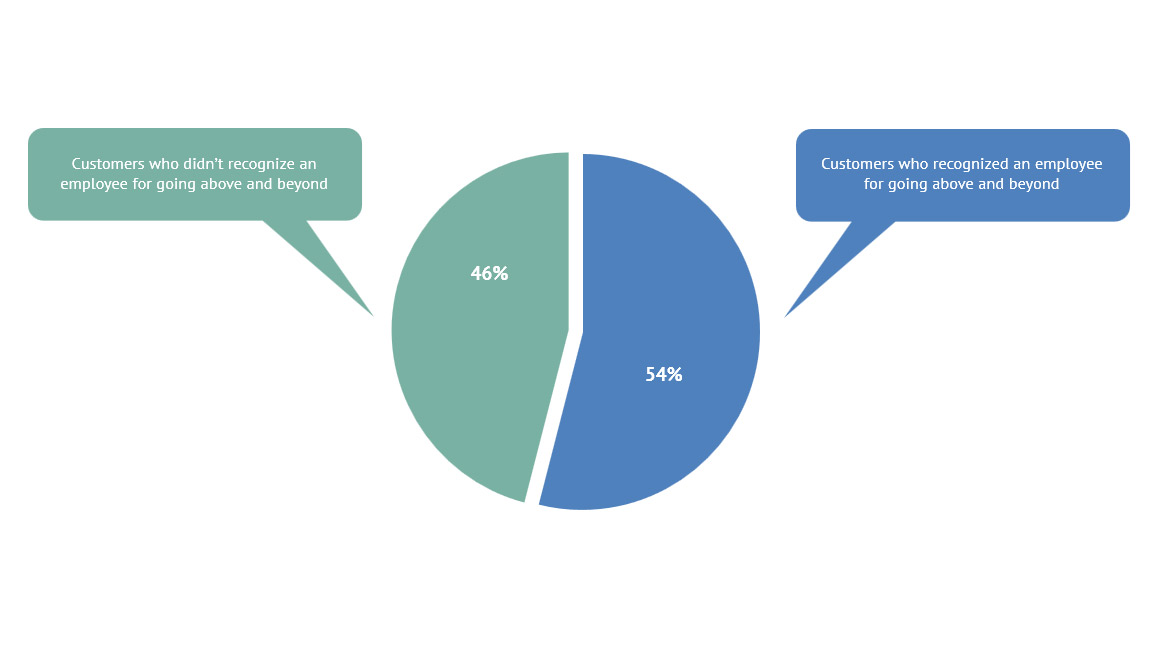

54% of all customers that give feedback on their experience also recognize an employee for going above and beyond for them.

That's an impressive statistic. The day-to-day grind of customer service work can be tough, but bank employees are delivering to customers. And customers are noticing.

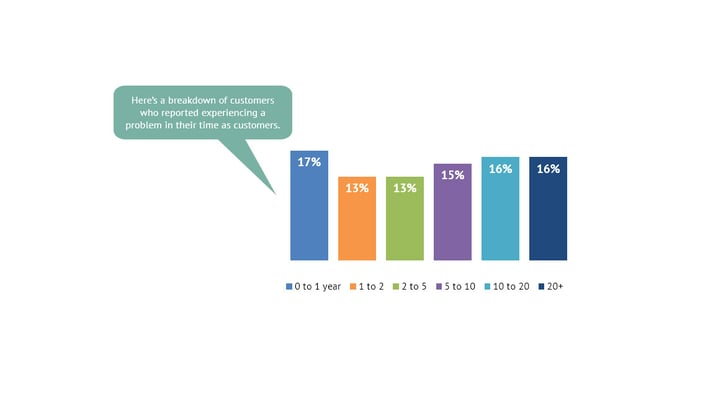

#2: New customers struggle most with their banks.

Customers who have been with their bank for under a year report the most problems. It’s important to support these customers in their early tenure, so they feel comfortable, supported, and confident in continuing to bank with you.

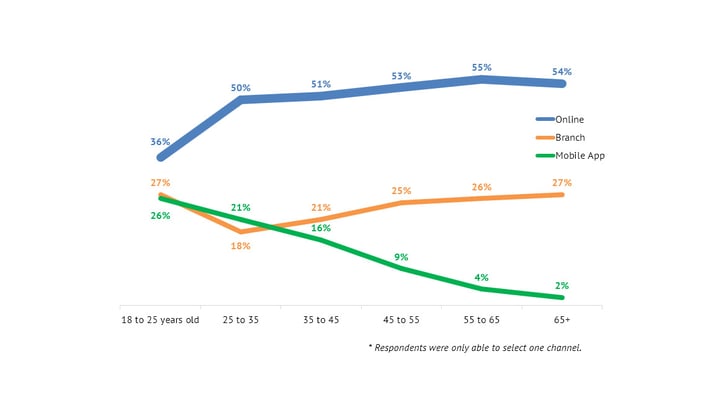

#3: Customers prefer online banking to other channels.

Online banking is the clear winner here, but there are some noticeable highlights. Of note is the dramatic difference between the youngest millennials (18 to 25 years old) and older millennials (25 to 35 years old). IT turns out 50% of the older millennials prefer online banking compared to only 36% of the younger millennials.

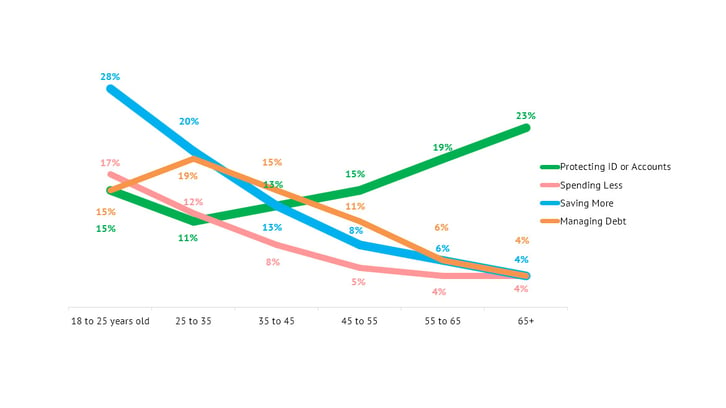

#4: A customer’s age impacts what they want from their bank.

When customers are young, they worry about saving more. As they get older, their concerns shift to identity and account protection. This reflects a customer journey that starts with amassing wealth in early years, and then protecting that wealth in later years. It seems intuitive on the surface, but this is important data for banks to consider as they think about how to onboard new customer and work to improve bank customer experience strategy.

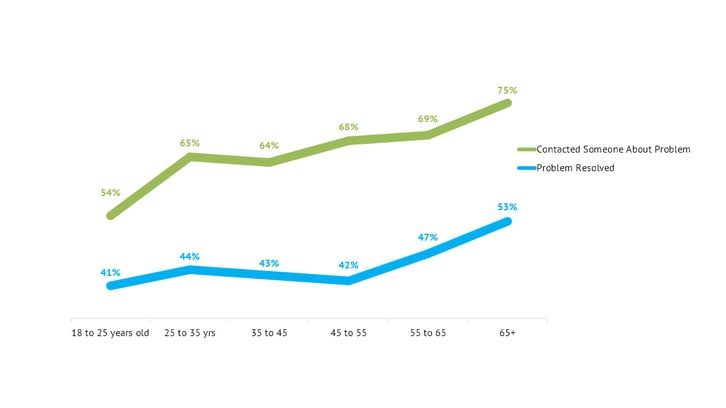

#5: Age affects problem reporting and resolution.

When customers experience a problem, it turns out age is a big determinant of what they do next. Older customers are more likely to contact customer service, and as a result, they’re more likely to have their problems resolved. Younger customers are less likely to contact customer service, and as a result, they are more likely to silently suffer from an unresolved problem.

Learn more about retail banking customer experiences.

These are only five insights from the report on customer experience for banks. To keep learning, download the full report here, or click the image below.

And if you’re interested in how PeopleMetrics can help you improve customer experience at your bank or credit union, reach out! We’d love to talk.

%20(1).png)